More About Invoice Factoring

Table of ContentsFacts About Invoice Factoring UncoveredThe Ultimate Guide To Invoice FactoringSome Ideas on Invoice Factoring You Need To KnowHow Invoice Factoring can Save You Time, Stress, and Money.

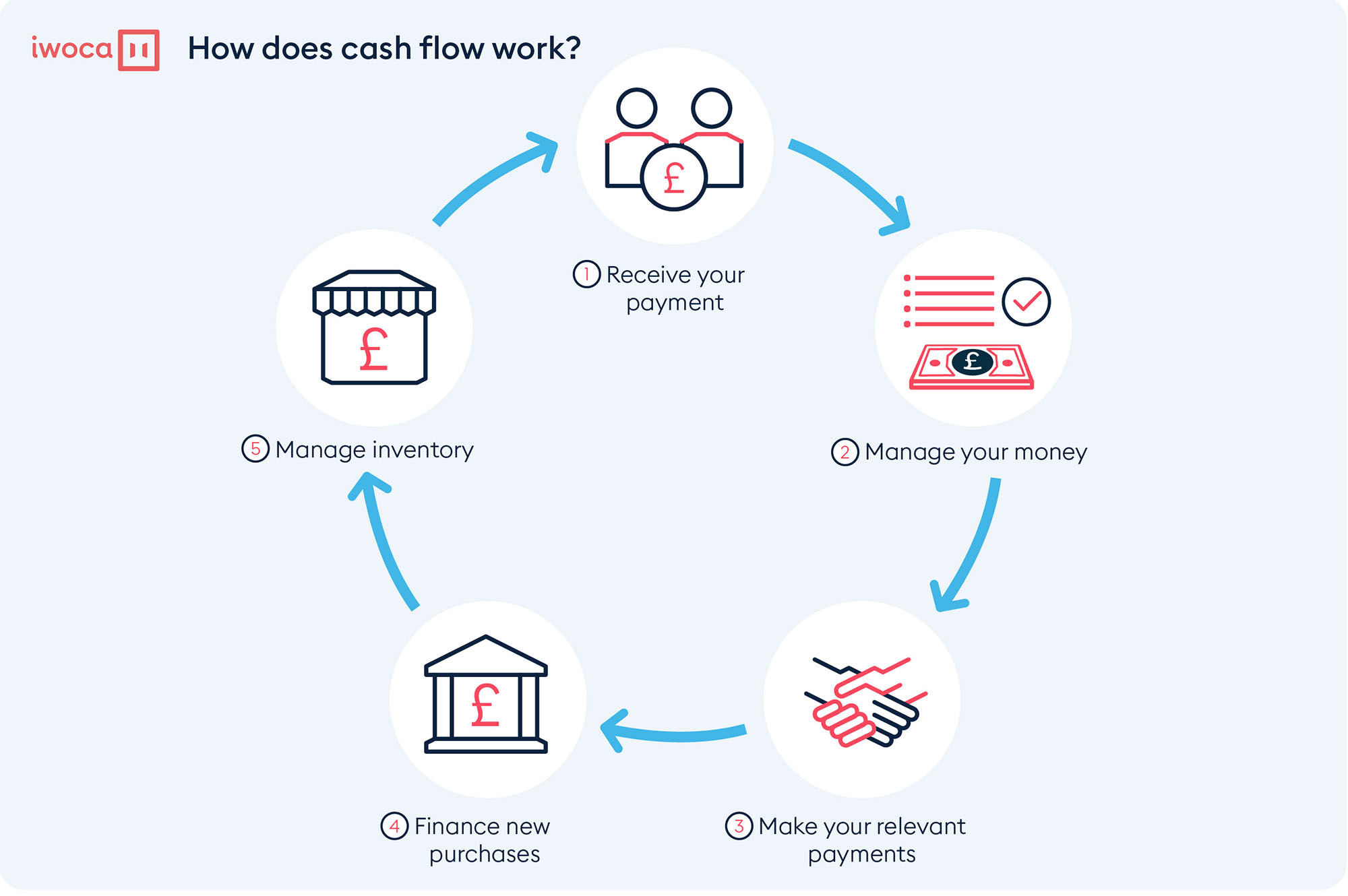

On the various other hand, with a non-recourse center the loan provider would certainly take in the cost, leaving your organization cashflow untouched. For this reason, lending institutions commonly call non-recourse 'uncollectable bill defense', since your company is safeguarded from the issue of non-payment. However, as you may anticipate, this will certainly make the factoring facility more costly total since the lending institution is approving a greater level of threat.Certainly, factoring includes credit report control so you'll have experienced credit rating controllers servicing your part to minimise this possibility but it's worth taking into consideration whether the threat of a recourse facility deserves the lower price. invoice factoring. With factoring, the costs are calculated a bit in a different way compared to service finances. Rather than a taken care of monthly repayment, the costs you pay are computed based on just how much of the center you have made use of, and the amount of job the loan provider takes into your account.

In our meaning, we developed that practically speaking, factoring isn't a lending, yet instead an acquisition of your receivables at a price cut. In other words, the lender gets your invoices for somewhat much less than they're worth. invoice factoring. This is called the price cut price, and also although it's practically not the same as an interest price, it functions in a similar way.

As an example, if your debtor book normally has a huge quantity of tiny billings, this will certainly call for more credit scores control job than a handful of large invoices, and also therefore your price cut rate might be higher. The lenders will likewise take into consideration the overall risk profile of your business as well as your customers.

The Greatest Guide To Invoice Factoring

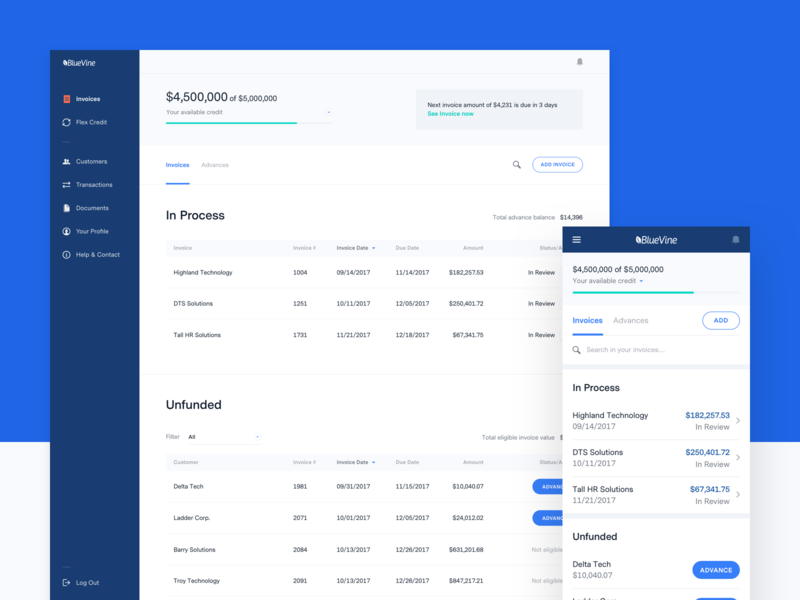

With a service charge evaluated 2%, the annual servicing cost would certainly be 6,000, or 500 per month. After that, the price cut rate would be related to that month's invoices. With 35,000 of billings undergoing the facility monthly, as well as a price cut price of 2.5%, the monthly discount price would be about 75. Totaling the price cut price and the service charge offers us a month-to-month overall of 575 which would be the overall price of getting breakthroughs on 35,000 well worth of billings.

Equally, your discount rate could be decreased if your instances of late repayment as well as negative financial obligation went down, or if you started dealing with a large and also creditworthy service. Also, as soon as a company has reached a specific size, it's commonly less costly to switch to invoice marking down, which is preferable for big businesses.

All about Invoice Factoring

There is a large array of factoring firms (likewise understood as 'aspects') on the market. Each of the huge high road financial institutions provide factoring, although some banks will only deal with their existing business clients, and lots of are really picky concerning which firms they use it to. Past the significant financial institutions, there are as numerous as 100 factoring companies in the UK, ranging from small regional service providers with a couple of loads clients, to huge service providers with hundreds of customers around the country.

Opposition financial institutions can offer affordable prices (although commonly not to the very same extent as their larger peers), and also these brand-new financial institutions normally have a solid hunger to do company. Allow us assist you discover the most effective financial product on the market. We will direct you with the entire process and also make certain you obtain the very best offer.

The Invoice Factoring Ideas

Like particular niche sector professionals, smaller regional suppliers offer a bespoke individual service, and also if times are difficult then accessibility to senior decision-makers at these smaller sized firms can make all the distinction in surviving a poor patch. Allow us help you discover the best monetary item in the marketplace. We will assist you through the entire procedure and make certain you get the most effective bargain.

Similarly essential, as factoring is designed to improve your functioning funding and cashflow, the lifeline of your business, the majority of firms wish to be functioning with a flexible and also responsive factor, especially if your business is having a hard time or growing promptly. Right here are some points to think about when you contrast factoring: Solution Does the company offer real evaluations and also testimonies? Are they a member of the Property Based Money Association?Price Don't simply consider heading prices, consider the entire series directory of costs which can often increase overall expenses.